|

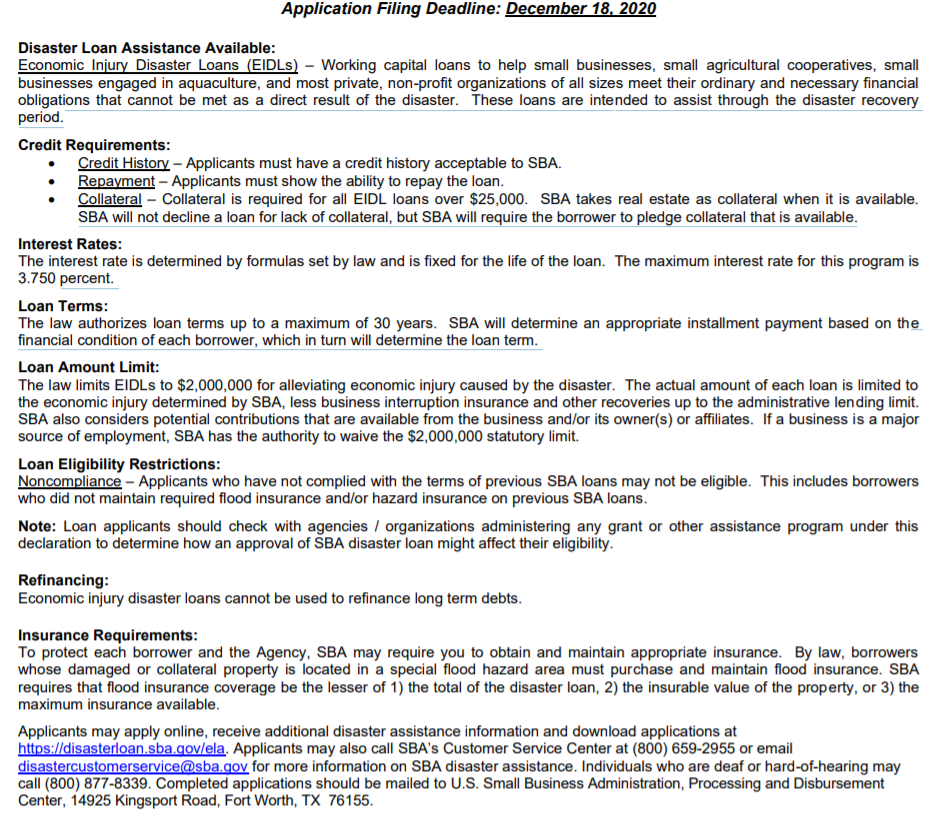

As of 3/21/2020, the SBA has opened the SBA Disaster Loan due to COVID-19 to many states, including PA, DE, NY, NJ, CT, MA, DC, MD, VA, NC, SC, GA, and FL. You can search for your area here - https://disasterloan.sba.gov/ela/Declarations/Index This loan is available to businesses as “Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.” This loan has a 3.75% interest rate (2.75% for nonprofits) with a repayment term of up to 30 years. Note that this is not a comprehensive list or instructions, but should help you prepare for your application. Businesses will be required to provide personal and business financial information including, but not limited to:

READY TO APPLY? disasterloan.sba.gov From the

U.S. SMALL BUSINESS ADMINISTRATION FACT SHEET – ECONOMIC INJURY DISASTER LOANS

0 Comments

Leave a Reply. |

ArchivesCategories |

|

Website by Odeh Media Group

Copyright ©2024 TSBAS.com, All Rights Reserved |

The Small Business Accounting Solution, Inc

50 South 1st Avenue, Coatesville PA 19320 (844) 208-2937 |

RSS Feed

RSS Feed