|

Governor Wolf and Rep. Dan Moul announce emergency loans are now available to small businesses with less than 100 employees. Information on the COVID-19 Working Capital Access Program (CWCA) can be found via the link below. This loan does not have an easy to access application, but must be requested through your local county CEDO. Please review the Fact Sheet for more information on applying for this loan. The COVID-19 Working Capital Access (CWCA) Program is administered by the Pennsylvania Industrial Development Authority (PIDA) and provides critical working capital financing to small businesses located within the Commonwealth that are adversely impacted by the COVID-19 outbreak. All CWCA loan applications must be submitted through a Certified Economic Development Organization (CEDO). For the list of CEDO’s operating within Pennsylvania, please refer to the CEDO webpage. Uses - Working capital, which for purposes of this program is considered capital used by a small business for operations, excluding fixed assets and production machinery and equipment. Eligibility - An eligible small business enterprise is a for-profit corporation, limited liability company, partnership, proprietorship or other legal business entity located in the Commonwealth of Pennsylvania and having 100 or fewer full-time employees worldwide at the time of submission of the application. For purposes of this program a retail/service enterprise is defined as a for-profit business entity that is involved in the business-to-business service, business-to-public service, mercantile, commercial, or point of sale retail sectors. An agricultural producer is defined as a business involved in the management and use of a normal agricultural operation for the production of a farm commodity. A “farm commodity” is any Pennsylvania-grown agricultural, horticultural, aquacultural, vegetable, fruit, and floricultural product of the soil, livestock and meats, wools, hides, furs, poultry, eggs, dairy products, nuts, mushrooms, honey products, and forest products. Funding and Terms - The maximum loan amount is $100,000. Loan terms are three years with a 12-year amortization. In addition, 1) No payments will be due and payable during the first year, 2) Principal and if applicable, interest payments will be due monthly for years two and three, and 3) A balloon payment will be due and payable at the end of the third year. The interest rate for the program is 0% except for agricultural producers in which case the interest rate is 2% fixed for the life of the loan. How to Apply - Loan applications are packaged by a CEDO that services the county your business is located in. The CEDO will work with you to determine if the CWCA loan program can assist with financing the needs of your business and will discuss with you in detail how the application process works. Visit the Certified Economic Development Organization webpage for a complete listing by county.

Questions about the program can also be directed to 717.783.5046.

0 Comments

The state of Florida has activated the Florida Small Business Emergency Bridge Loan program.

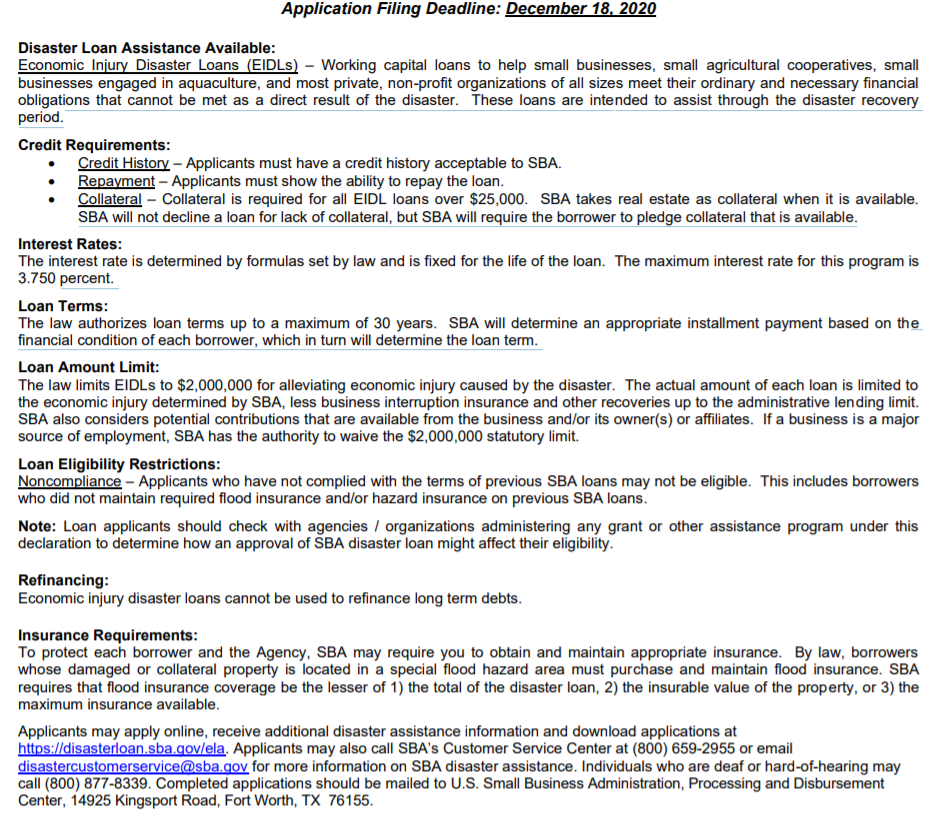

Details can be found: https://floridadisasterloan.org/ The Florida Small Business Emergency Bridge Loan Program is currently available to small business owners located in all Florida counties statewide that experienced economic damage as a result of COVID-19. These short-term, interest-free working capital loans are intended to “bridge the gap” between the time a major catastrophe hits and when a business has secured longer term recovery resources, such as sufficient profits from a revived business, receipt of payments on insurance claims or federal disaster assistance. The Florida Small Business Emergency Bridge Loan Program is not designed to be the primary source of assistance to affected small businesses, which is why eligibility is linked pursuant to other financial sources. Note: Loans made under this program are short-term debt loans made by the state of Florida using public funds – they are not grants. Florida Small Business Emergency Bridge Loans require repayment by the approved applicant from longer term financial resources. Application can be found: https://floridadisasterloan.org/application/ As of 3/21/2020, the SBA has opened the SBA Disaster Loan due to COVID-19 to many states, including PA, DE, NY, NJ, CT, MA, DC, MD, VA, NC, SC, GA, and FL. You can search for your area here - https://disasterloan.sba.gov/ela/Declarations/Index This loan is available to businesses as “Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.” This loan has a 3.75% interest rate (2.75% for nonprofits) with a repayment term of up to 30 years. Note that this is not a comprehensive list or instructions, but should help you prepare for your application. Businesses will be required to provide personal and business financial information including, but not limited to:

READY TO APPLY? disasterloan.sba.gov From the

U.S. SMALL BUSINESS ADMINISTRATION FACT SHEET – ECONOMIC INJURY DISASTER LOANS |

ArchivesCategories |

|

Website by Odeh Media Group

Copyright ©2024 TSBAS.com, All Rights Reserved |

The Small Business Accounting Solution, Inc

50 South 1st Avenue, Coatesville PA 19320 (844) 208-2937 |

RSS Feed

RSS Feed