|

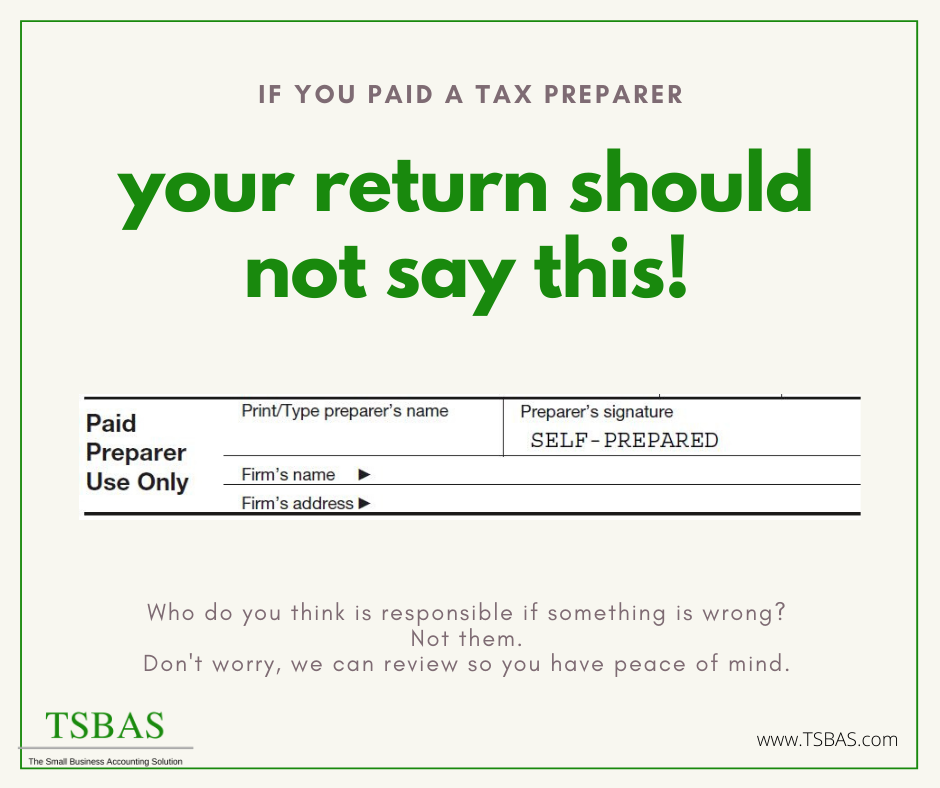

No matter how many times we see it, we can’t help but smile at the failings of individuals when it comes to paying their taxes. Last month, we’ve learned that what happens in Vegas doesn’t stay in Vegas, as a Las Vegas man, King Isaac Umoren, the owner and operator of Universal Tax Services, was indicted on charges he not only fraudulently prepared tax returns for clients, he used his employees’ preparer tax identification numbers without their consent. He is facing up to two decades in prison if guilty and hefty fines. Shakespeare mentions, in King Lear, “the first thing let’s do, is kill all the lawyers.” Now, no matter what you think about this, a Houston, Texas attorney thought he would make a killing by illegally transferring in 18 million dollars in untaxed incomes, despite knowing it had never been taxed. The U. S. government successfully proved in court the man had conspired to move the money into the United States for a 25% ownership stake and nearly 4.8 million dollars in payments. We think it would have been easier to just pay the taxes! It doesn’t take a lot to wonder about some of the news we see coming out of Florida any given day, and our next case is no different. The United States District Court for the Middle District of Florida has permanently barred defendant Gladys Quiles from preparing federal tax returns for others. The interesting thing about this case was that Quiles acted as a “ghost preparer” for individuals, helping them to overstate deductions and maximize their returns. Even stranger? She was not present to defend herself in the proceedings leading us to believe she might really be a ghost. This case is intriguing because the IRS considers “ghost preparers” to be one of the top challenges to proper filing and this type of fraud is actually on the IRS “Dirty Dozen” list for top tax problems. If you work with a tax preparer, make sure their name is on the preparer line or you will be the ONLY ONE on the hook if something goes south! If you paid for it, it is NOT "self prepared" and you should be aware that the person you paid is not working legally or in your best interest. That is what I have for this today! Stay warm, friends,

To ensure we don't make the folks at the IRS ornery, we inform you that any U.S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed